Funding Finder

Funding Finder is a tool that matches Borrowers’ funding needs to private lenders who specialise in short-term debt, property development finance and business term loans.

The founder of Funding Finder was looking to turn this start up idea into a reality. The goal was to launch the MVP within budget and compressed timeline and have in place a continuous development to expand more features.

Context and problem

Loan submission, approval and settlement process is a process that involves massive paperwork, complexity and waiting periods.

For the borrower, completing a lengthy form and providing a complete set of information is a stressful step to getting the loan they want.

We helped the founder unpack business requirements and ideas. Together we defined key user problems, needs and hypothesis of the Funding Finder.

A research and analysis on competitors was also carried out to identify the platform's key differentiator that would drive its success.

Scope

Competitors analysis

User Experience

User interface design

Brand evolution

Usability Tests

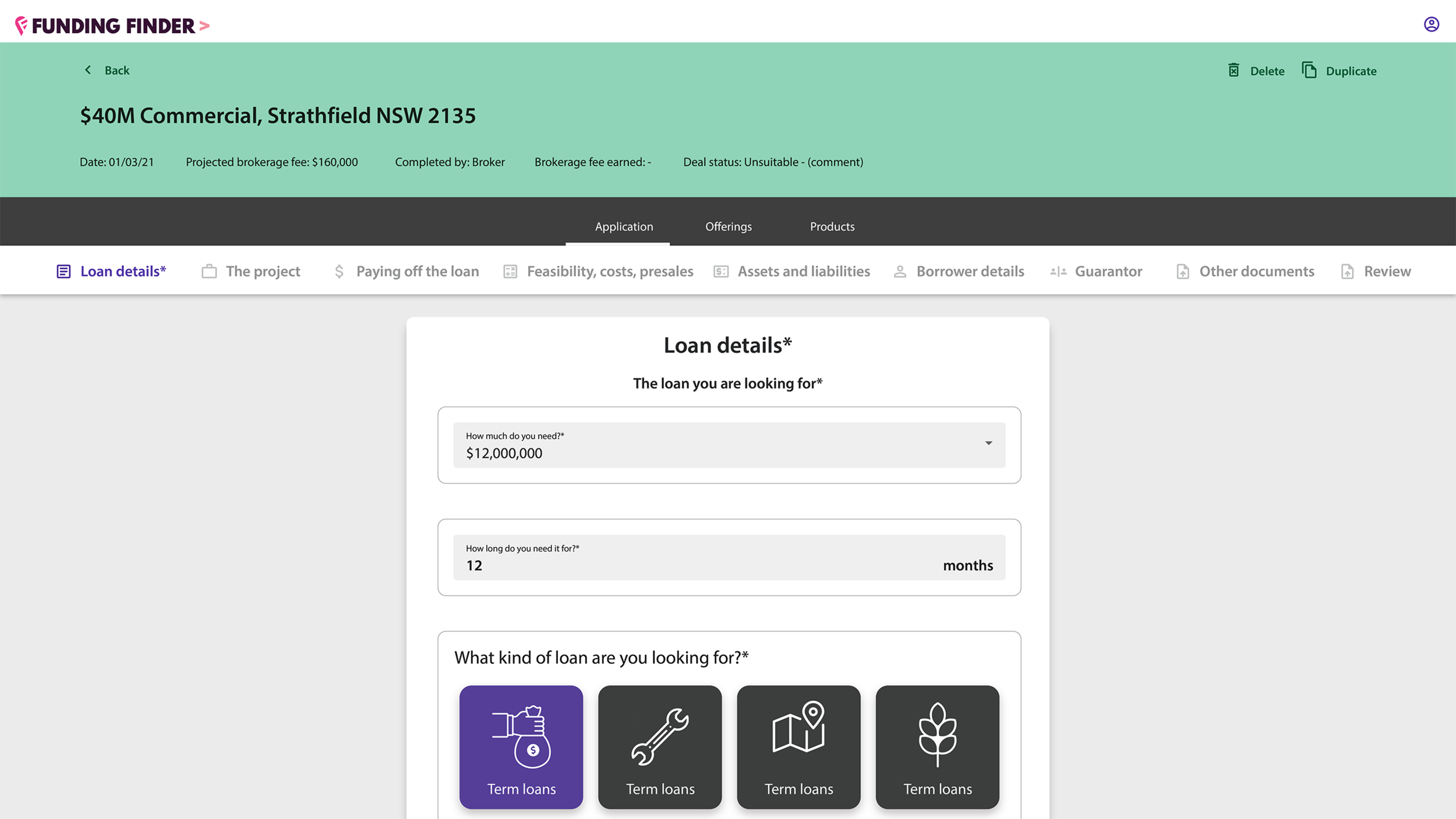

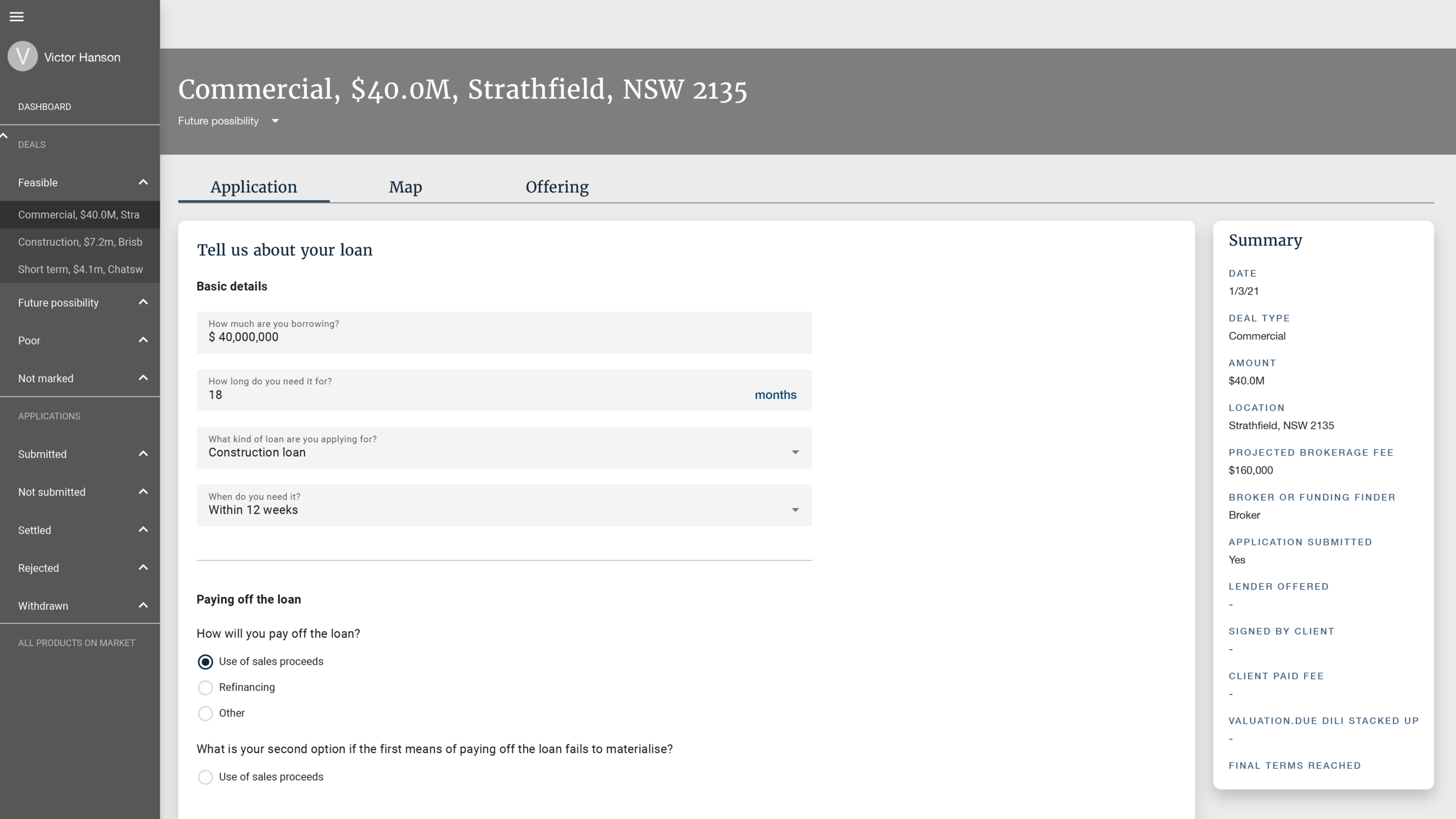

Loan application

Streamlining the loan process

The workflow for the borrowers was streamlined by using steppers so that users could visit at a later time to fill in some unfinished fields easily without having to scroll through endless questions.

The platform provides incentives for completing the form. Fees get discounted if the borrower inputs all relevant information and completes the loan application.

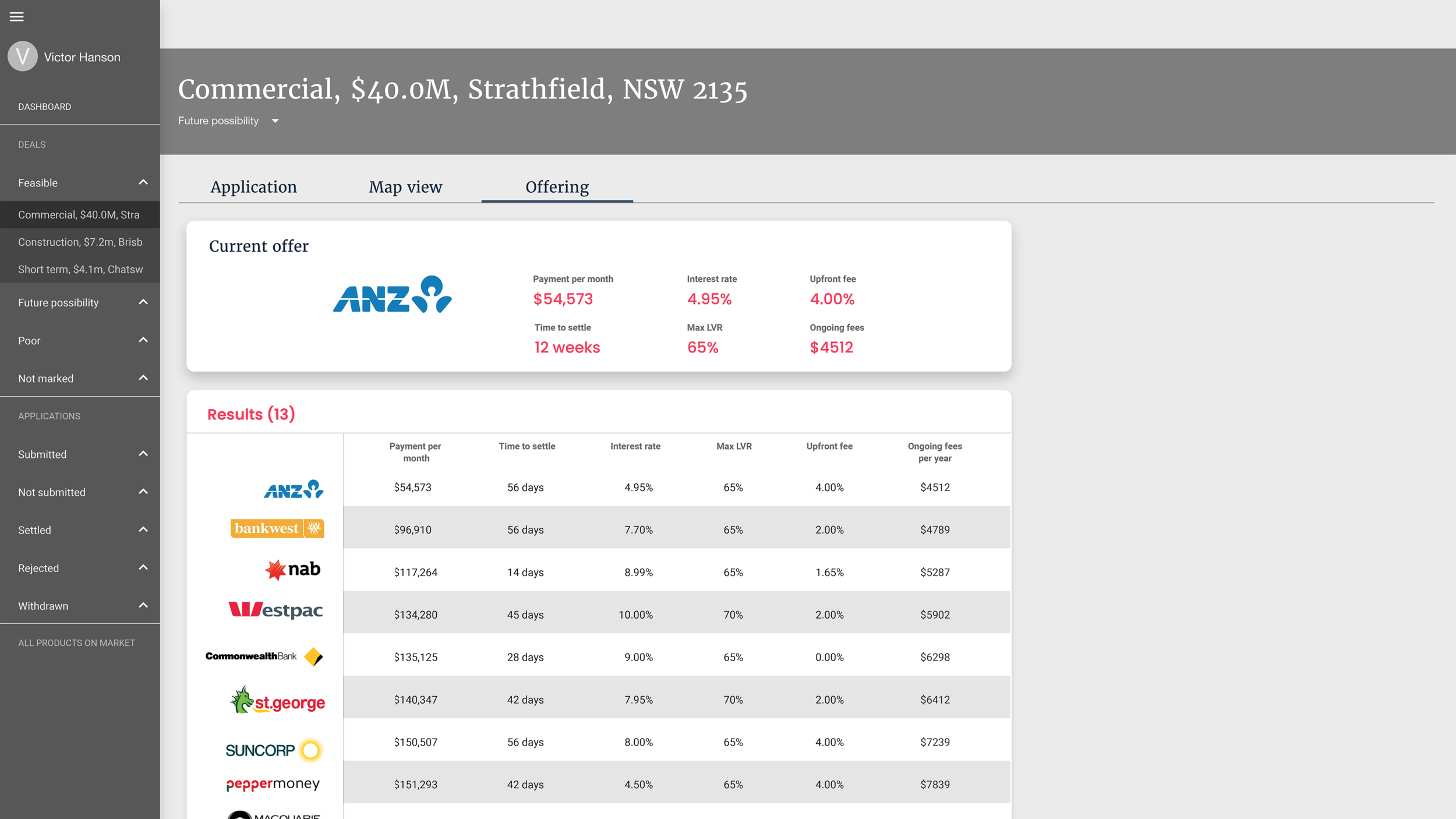

Lastly based on the answers in the form, Funding Finder uses a computer algorithm to match the borrower with top lending products that best meet their needs.

Recommendations for the borrowers

As a borrower answers more questions, the application continually narrows down and recommends a list of loan products best suited to the borrower’s needs.

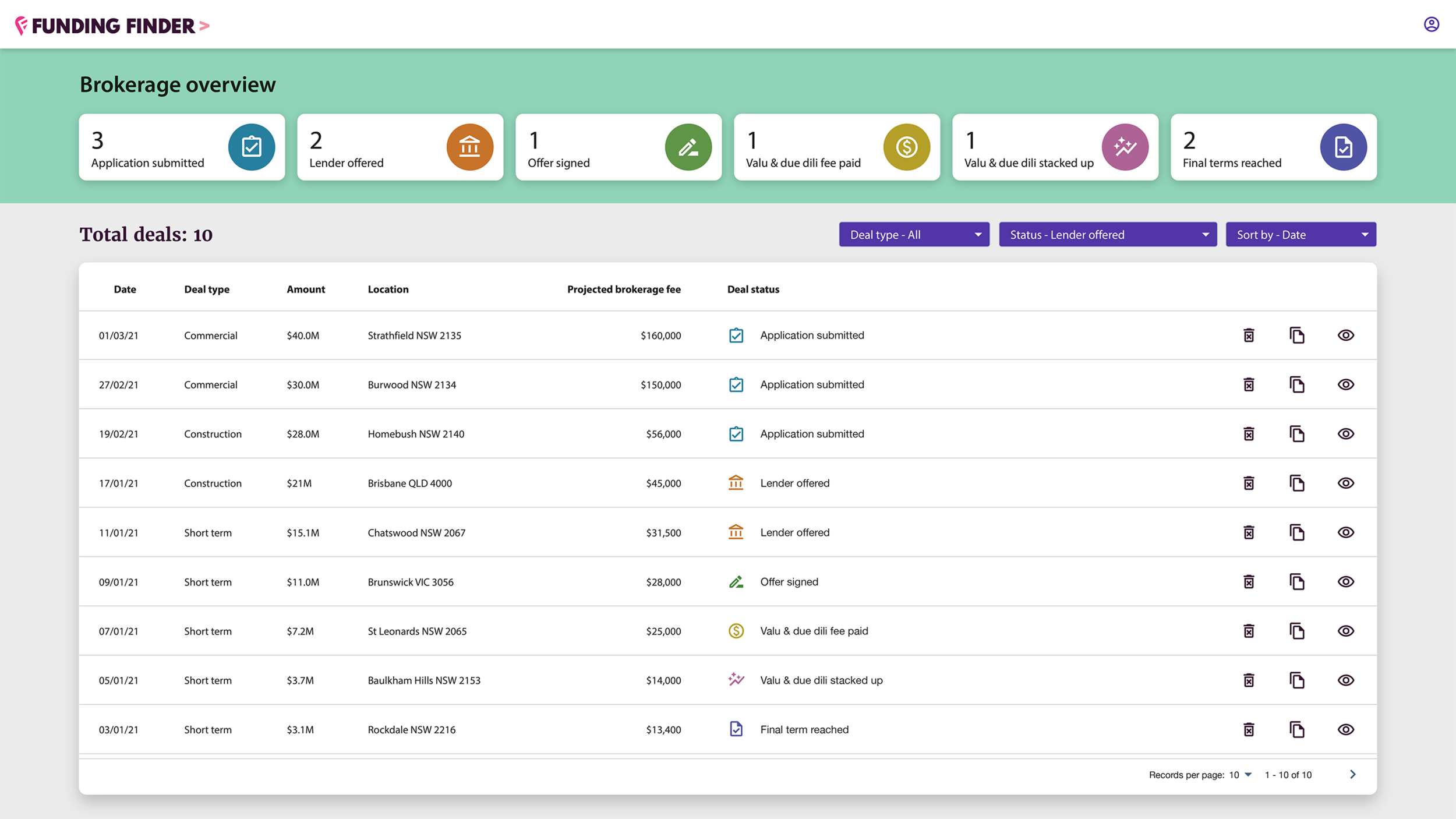

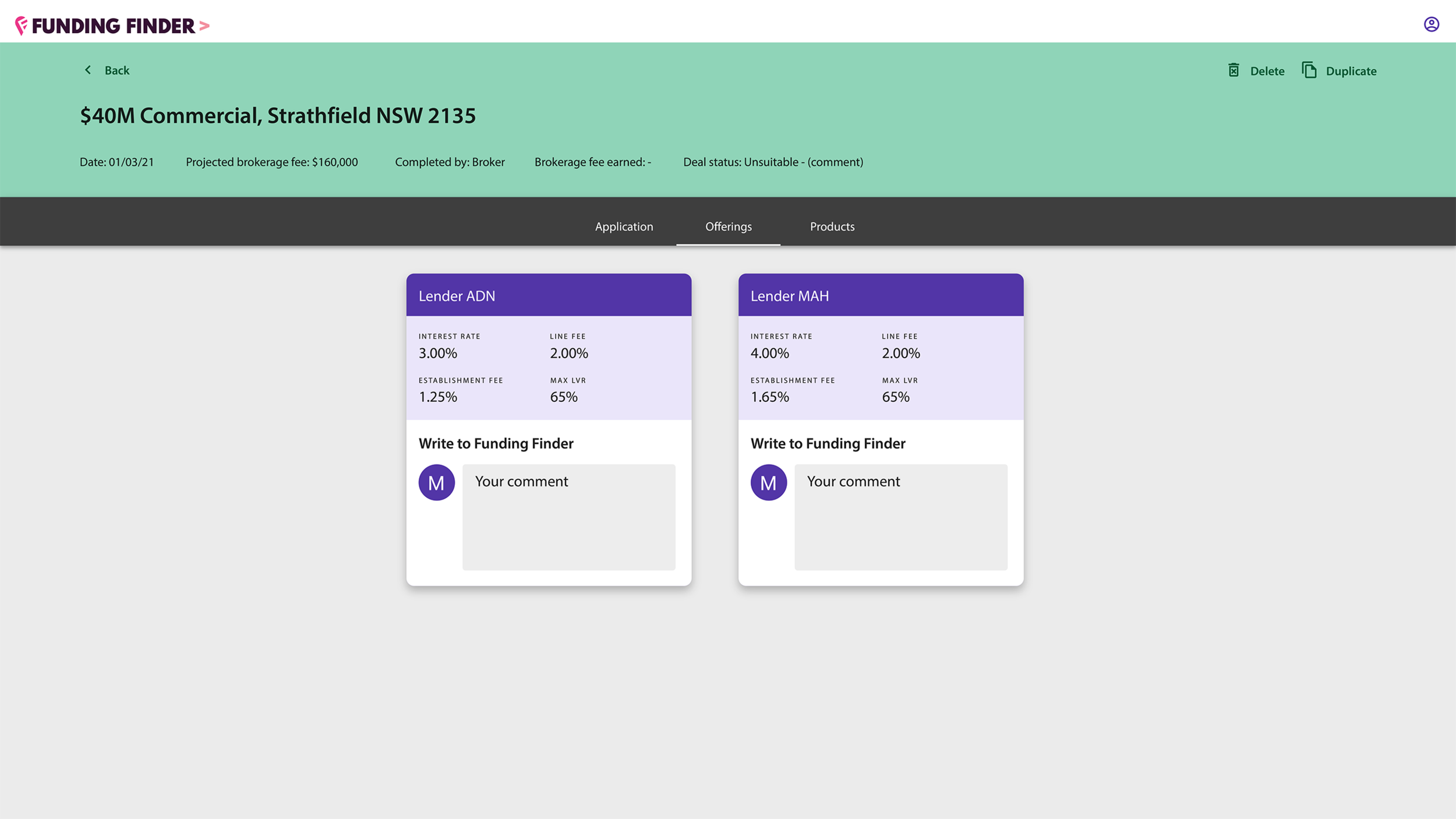

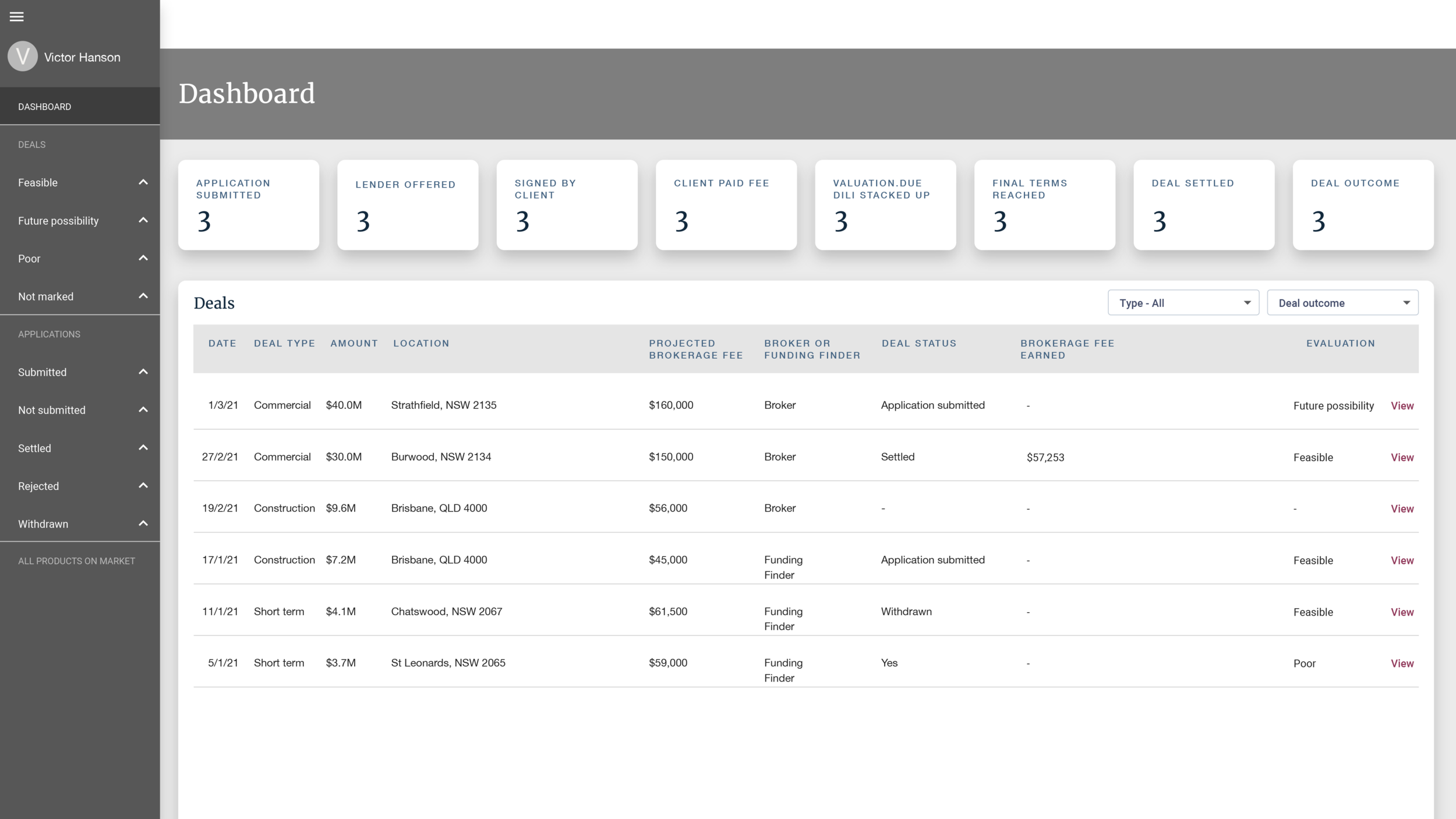

Broker Dashboard

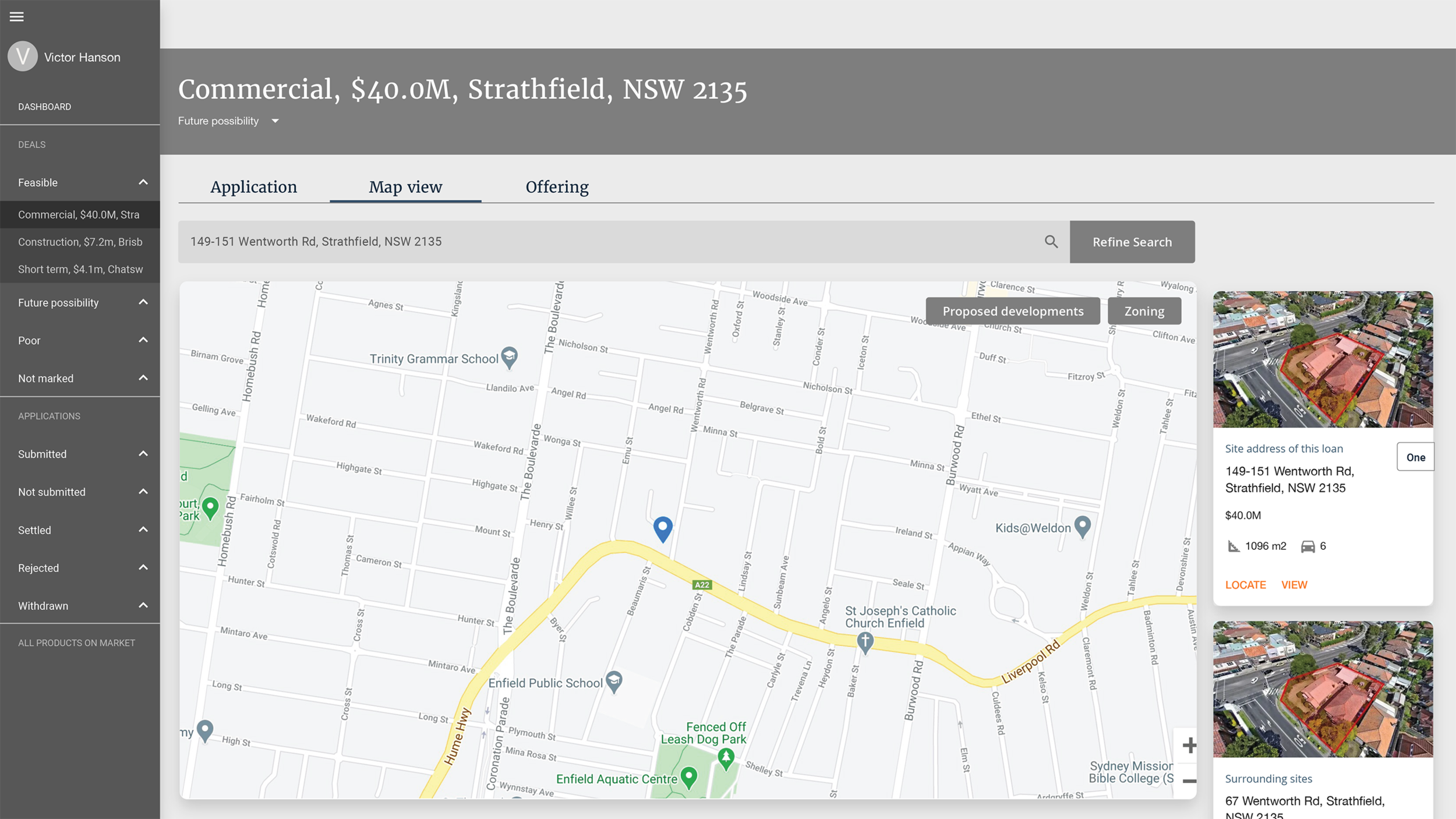

Assisting the brokers

A dashboard was designed with the brokers in mind, assisting them to manage and track multiple deals’ status, review an application in order to assist their clients. The broker dashboard provides a clear, real-time picture of deal status so that brokers can understand when their client would get funded and when they might get paid.

Achievements

The MVP of the Funding Finder tool was designed, developed and launched within three months and under budget.

Streamlined workflow for brokers, reducing hours taken to process a loan.

Designed a platform summarizing market product information tailored to a borrower’s capacity.

Created a user-friendly loan application process with incentives to encourage user completion.

Below details the end-to-end design process

Artefacts of end-to-end design process

Information architecture of the loan application

Discussion and ideation were carried out with the team to iterate the user flow of the IA (shown on the right).

Task analysis between Funding Founder CT and brokers

Information Architecture of the broker dashboard

Wireframe for the Broker Dashboard

Final designs of Broker Dashboard in desktop view